In this blog series, sales performance management (SPM) consulting firm OpenSymmetry explored key sales compensation plan design components and considerations for team-based incentivization. Continuing in the third installation of this series, we’ll examine different scenarios for which measuring sales performance by revenue and by margin are the most appropriate.

All sales compensation plans should have some form of financial metric in order to hold salespeople accountable for delivery of their targets and support the achievement of corporate business goals. Depending upon the economic times (e.g. recession vs. growth markets) and who is holding the reins of the company (e.g. sales vs. finance), the conflict has always been: what is the right financial measure for sales performance – revenue or margin? For this article’s purposes, we will define revenue as total sales volume or price and margin as the total profit from the sale (revenue minus cost of sale).

Delivery of revenue growth without margin will not help the company achieve its forecasted profit objectives. On the other hand, margin without revenue growth can be a limiting factor. While it may result in some profit, it will not assist the company to achieve the growth expectations of its stakeholders and field salespeople.

What are the considerations in whether to use revenue or margin?

While revenue growth is a requirement today for all sales forces, as competition increases and product differentiation becomes more difficult, the need to ensure margins are enough to fund the growth and operate the business becomes critical. Here are the top questions to ask to determine whether a sales organization should measure sales performance by revenue or margin:

- How much can sales reps influence margin? One of the primary considerations in determining which is the appropriate performance measure is the degree to which the sales representative can influence margin. In reviewing situations that indicate whether a sales job has the potential for a margin compensation measure, Colletti-Fiss for WorldatWork cite the degree to which the sales rep plays a critical role in the company pricing strategy and the authority to discount and structure deals as a defining factor. Further, the development and implementation of new tracking and monitoring tools will enable companies to move in this direction because reps get immediate feedback on the effect higher margin has on their plan payout.

- What is the life stage of the company? The company “life stage” often is a significant driver of performance measure choice. For example, in smaller start-ups and periods of high growth for businesses, driving incremental revenues and product traction is the lifeblood of the company. During these seasons, introducing customer product adoption performance metrics, like revenue, into the sales compensation program is important; however, this also takes place in an environment where there is a lack of infrastructure and margin management, and securing deals leads to increased discounting and erosion of margin. In order to sustain growth and profitability, there will need to be a transition to some element of margin in the reward methodology.

- What type of “margin” is being measured? Another consideration is the definition of margin that is to be used, whether gross profit margin (total revenue minus cost-of-goods-sold), operating profit margin (revenue minus cost-of-goods-sold and operating expenses) or net profit margin (revenue minus all expenses including interest and taxes). Depending on the source of information (e.g. sales, marketing, finance, operations etc.), you will get different perspectives on the importance of different margin measures. If you cannot get a consensus on what margin measure is appropriate for sales crediting, you may need to opt for revenue as the common denominator.

- What is the economic climate? In tougher economic times, companies that are more finance-driven focus on reducing costs and expenses to align with changes in customer spending and fluctuating revenues. This is critical to preserving cash, market share and maintaining profitability, so plans during these times typically have less scope for discounting. The plans then either focus strictly on margin, or if the salesperson cannot influence margin, then straight revenue. However, in order to come out of an economic downturn and create sustained financial success, growth is essential. Sales at any cost, such as heavy discounting, do not generate sustainable growth, but rather consume considerable resources and set expectations with customers that are difficult to change when times improve. Moving forward, organizations that focus on growth while expending the effort to achieve and reward the required level of profit measurement ultimately will be more successful.

- How are customers acquired? More recently, the evolution of the supply chain management profession and RFP (Request for Proposal) processes have conspired to wring any potential profit out of the sales channel. To focus only on revenue or margin at the exclusion of the other gives home court advantage to procurement. The depth of relationship between buyers and sellers that ensures smooth product or service delivery, as well as the value that a provider can bring to the customer with a best-in-class solution, can only be achieved if margin is a part of the equation. Therefore, to initiate and reinforce behaviors and outcomes that combine both revenue growth and required margin, the compensation plan must pay for transactions or target achievement that incorporates both.

- How are quotas set for the sales team? With a straight volume or revenue target, quota achievement can be accomplished through selling low-margin, easy-to-sell, “door-opening” products or services. To ensure profitability, volume and revenue need to have the right mix of products and services in overall sales with a margin mix that delivers the required levels of both growth and profitability for the business.

How do you reward for profitable sales?

Achieving sustained, profitable sales requires adoption of performance measures that include both the required growth in revenues to satisfy stakeholders, while ensuring that attention is paid to margin on either a transactional or target-driven basis. Your sales team wants what is best for the customer and the company as well as themselves. To support this credo, the sales compensation plan needs to communicate to salespeople what your organization values and where they should focus their time and effort. Having performance measures in the plan, specific to the sales role and that create a focus on both revenue and margin, is a recipe for success.

There are several ways to address both margin with revenue growth. These include:

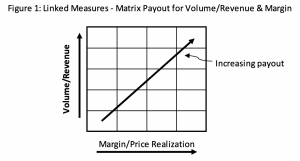

- Linked measures

An incentive payout that is tied to achievement of revenue and volume targets, as well as margin or price realization. This is often done using a matrix table that pays out depending upon the amount of revenue/volume and the margin/price realization on the sale. Payout is optimized when both elements are maximized.

- Differential commissions for products with different margins

When a suite of products or services being sold have different margins, performance and behavior can be focused when the commissions paid vary by profit, thereby linking the payout to the margin in the profit. For example:Product “A” – Commission rate = 2%Product “B” – Commission rate = 4%Product “C” – Commission rate = 8% - Discrete targets for revenues and margins

Different measures, including setting separate quotas and incentive payouts for both revenues and margins. For example:Revenue/Volume Target #1 – Bonus paid for 100% = $3,500.00Margin Target #2 – Bonus paid for 100% = $1,500.00

- Margin modifier on revenue achievement

On transactions or on total sales, use modifiers to increase or decrease the payouts for revenues, depending on the margin on each sale or the average margin on all sales. For example:Performance Bonus Payout Average Margin Modifier Total Payout 120% $4,000 20% 1.5 $6,000 110% $2,500 15% 1.2 $3,000 100% $2,000 10% 1.0 $2,000 90% $1,000 5% 0.9 $900 80% $500 3% 0.8 $400

- Margin threshold for payout

Set a margin threshold, below which commissions are lowered or eliminated on transactions. For example:

Commission Rate on sales revenue with 10% gross margin = 6%- If gross margin is between 5% – 10% commission rate = 3%

- If gross margin is less than 5% no commission will be paid

These are just a few examples of how to incorporate revenue and margin into your sales compensation plan. Choosing the best metrics to ensure profitable sales will be essential to long-term sales success and rewarding your salespeople for doing the “right” job.

This article is a continuation of a series of guest posts, by OpenSymmetry for the Sales Management Association, on optimizing sales compensation plans for any organization. For a deeper dive into designing high-performance sales compensation plans, join us for our webinar on September 4, 2019.